We are closing in on the end of the day on Thursday in the European session and, for our bitcoin price analysis this evening, we are going to change things up a bit to try and incorporate the expense of overnight action as it plays out into tomorrow morning.

Action today has been relatively strong, with bitcoin scoring fresh intraday highs and currently trading in and around the upper end of its intraday range. The hope is that sentiment will stay bullish and that, in turn, that today’s range will break to the upside. Of course, we’ve got to be wary of the fact that things might not plant exactly like this, but we can hope.

So, with our rambling out of the way, let’s explain what we are going for this evening.

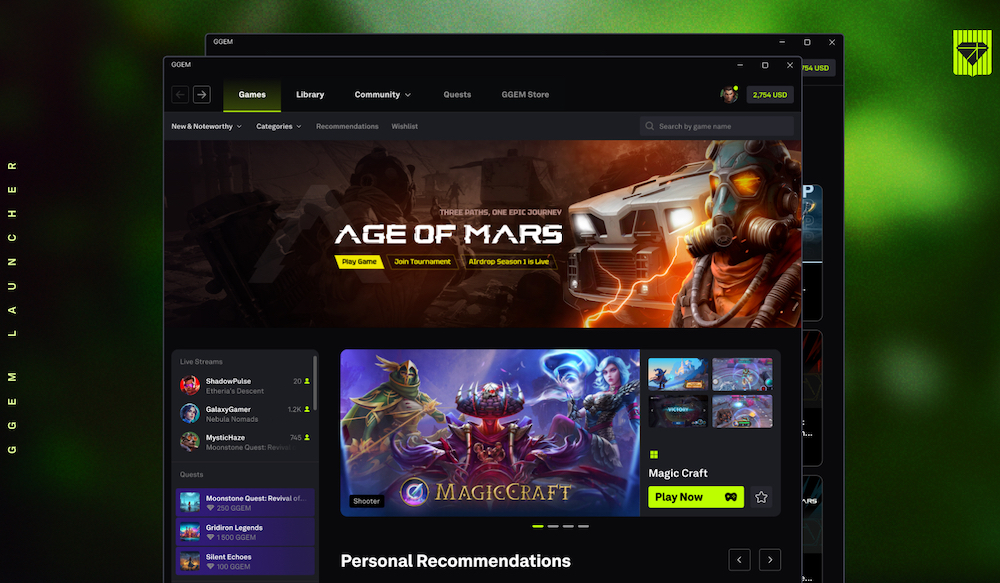

As ever, take a quick look at the chart below before we get started so as to get an idea where things stand and where we are looking to jump in and out of the markets according to the rules of our intraday strategy if and when things move.

It is a one-minute candlestick chart that has our primary range overlaid green.

BTC Daily Chart

As the chart shows, the range that we are using for this evening is substantially wider than we normally go for and that’s because we are looking to go at the price with an intrarange strategy as opposed to a breakout strategy – at least for the time being.

So, if we see price bounce from current levels in and around support, we will enter long towards an immediate upside target of 8500 (resistance). A stop loss somewhere in the region of 8100 works well to define risk on the trade.

Looking the other way, if price corrects from resistance, we will enter short towards an immediate downside target of support. A stop loss on this one at 8600 looks good.

Charts courtesy of Trading View